Insurance for Real Estate Firms

Coverage for the Real Estate Firm

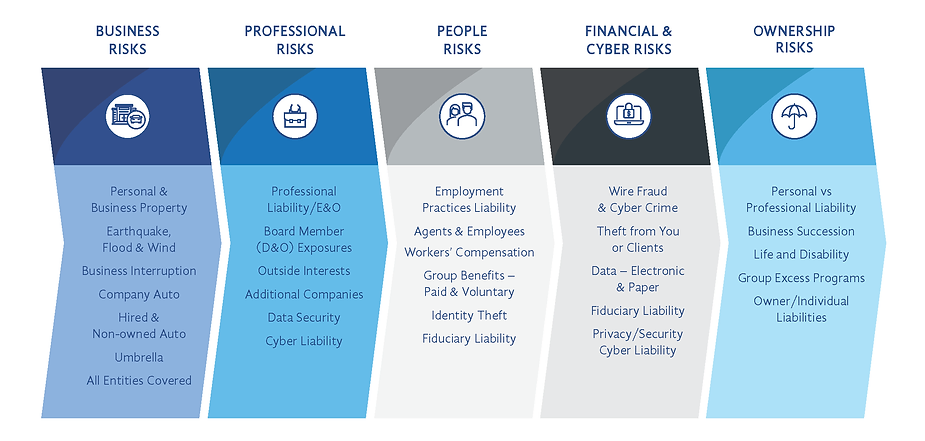

Working on a national basis, RiskPoint takes real estate industry clients through a process to analyze risk and provide extremely competitive and comprehensive insurance solutions. We drive down the cost of risk and protect the company and its people against the ever-changing claims landscape. Whether it’s E&O, cyber liability, business package insurance, employment practices, or crime, RiskPoint can deliver full service Real Estate specific solutions to protect you.

We’re not here to win on price. Let us correct that by saying, of course we want to save you and your firm money, that is definitely the goal. However, we want to do more than that. Our number one goal here at RiskPoint, is to get to know your business inside and out. We take a fine-tooth comb to your policies to see where you may be lacking coverage, or where you may be paying for excess coverage.

Types of Coverage

Professional Liability

This Coverage protects the firm from claims arising from professional Real Estate Services including coverage for:

- Agent-owned Property Transactions

- Legal Assistance

- Lockbox and Open House Coverage

- Mold Coverage

- Public Realtions Services

- Fair Housing Discrimination

- Failure to advise Coverage

General Liability

This Coverage will protect your real estate business from certain lawsuits alleging injuries or property damage that occurred as the result of your business operations such as a client tripping in your office and being injured or if you accidentally damage a client’s property during a showing or appraisal.

Cyber

This Coverage helps protect and respond when a Cyber Incident occurs. Available coverage includes:

- Funds Transfer Fraud

- Phishing

- Notification Expense

- Ransomware

- Bricking

Property

This Coverage helps protect the location of your real estate business and the tools and equipment you use, such as computers, signage, tape measures, and office furniture – whether you own or lease them.

Employment Practices Liability

This coverage provides protection against not only actual but alleged acts of discrimination, retaliation, sexual harassment and wrongful termination.

Auto

In the event that a vehicle owned by you or an employee of your Real Estate business is involved in an accident while working, Hired/Non-Owned Auto Liability insurance may help cover the costs your business incurs related claims of bodily injury or property damage.

Our Real Estate Team

Blake Schellenberg

CEO & President

Annie Neal

Vice President

Dee Brown

Account Manager

Shannon Connor

Benefits Account Executive

Mandi Roney

Benefits Account Executive

Kiel Todd

Account Manager

John Austin

Producer

Lauren Santillanez

Commercial Account Manager

Real Estate Articles

Real Estate Professional Liability: Should You Share Flood Risk Assessments?

When it comes to flood risk, what homeowners don’t know can absolutely hurt them. A single flooding event can cause significant damage, but many homeowners don’t understand the risks. New flood maps could give homeowners the information they need to prepare, and it’s...

Real Estate Cyber Risk: A Growing Threat

Real estate firms are going digital – and taking on new risks. Online communication, virtual showings and other digital tools have created new opportunities, added convenience and enabled work to continue during the pandemic, but all of these new tech tools come with...

Professional Liability Exposures for Real Estate Brokers

As a real estate broker, you have big responsibilities and when things go wrong, the consequences can be significant. To avoid professional liability claims, beware of these common exposures. Breach of Duty and/or Contract Violation One of the most common claims is...